What is a microloan?

Here’s your guide to everything you wanted to know about microloans.

Do you keep hearing the word microloan, but don’t know what it means? At Taaluma Totes, we have a lot of experience with microloans, we’ve funded over $250,000 of them. So we put together this guide to help you out!

What is a microloan?

Microloans are (well, like it sounds) micro loans. The microloans we fund average between $500-1,500, so they are a lot smaller in size than typical loans.

Borrowers use the microloan for a specific purpose. For example, they may use it to pay for school tuition or to expand their business.

What’s the difference between loans and microloans?

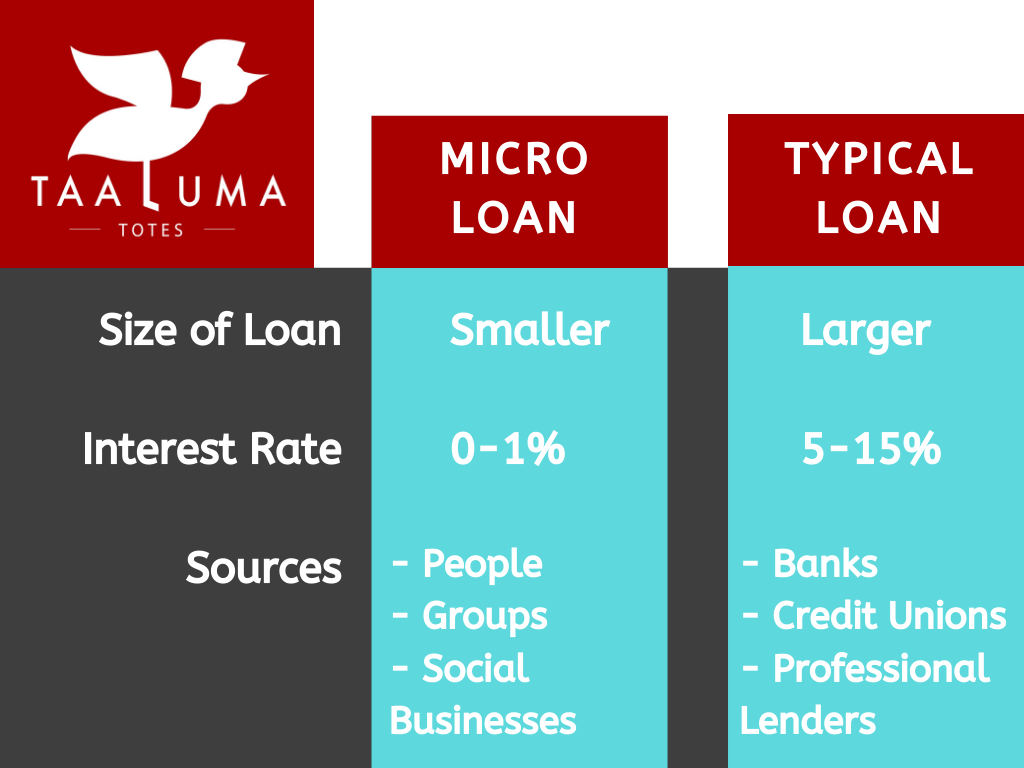

Microloans are very different than conventional loans.

- Microloans are usually a lot smaller than typical loans. We’ve seen microloans as small as $150.

- Microloans have low interest rates. Typical loans, especially payday loans and auto loans, have high interest rates. We don’t charge any interest on the microloans we fund.

- Microloans are usually funded by several people. For example, a few businesses may come together to fund a microloan. Conventional loans are typically funded by financial institutions, like a bank.

- Microloans have no guarantee of repayment. Often, conventional loans require collateral before the loan can be made.

Why do microloans exist?

Microloans exist for when it is hard to get a loan from a bank or financial institution. This could be because banks don't operate there or they refuse to lend to a certain segment of the population.

Another reason why microloans exist is because typical loans can be very expensive. Some loans make it near impossible to pay back due to the high interest rates, especially in developing countries.

Where do you give microloans?

We give microloans all across the globe! So far, we've funded microloans in 59 countries.

Who receives your microloans?

Reputable microloan programs examine all potential borrowers before deciding to lend.

This typically includes:

- Verifying their identity and business information.

- Screening them through security and fraud databases.

- Assessing their past loan history

- Taking other precautions to ensure they are a legit borrower and that the loan is for good purposes only

It’s also typically required that borrowers first fundraise from people in their community before they can get a microloan. That way they are accountable to people in their local community for maintaining a good character and business.

After being vetted, we assess the social impact we think the microloan will have. We look across different categories such as:

-

Fighting poverty

-

Decreasing hunger

-

Ensuring health and education

-

Promoting sustainability

We dive into the borrower’s story and go over all the details of how the microloan will be used.

The microloans that will have the highest impact are the ones we decide to fund.

Are microloans effective?

The microloans we’ve funded have created a lot of change. They have improved communities and combated poverty.

We’ve seen first-hand how a small amount of money can go a long way. Our microloans have empowered farmers and small business owners to expand their operations. By expanding their operations, they can provide more products and services to the people around them. This leads to many good things such as:

-

Less waste

-

Job creation

-

Filled needs in the community

-

More affordable living

-

A better quality of life for families

In case you were curious, here’s some of the microloans we’ve funded recently.

Do you make money on the microloans?

Nope! We don’t make any interest when we fund microloans. We don’t care about being a bank, we only care about seeing people & communities flourish.

What areas have you funded microloans for?

The microloans we’ve funded have gone to many sectors including:

- Farming

- Retail

- Construction

- Transportation

- Hotels

- Medicine

- Food services

- And many more

Business owners in these sectors are solving real problems in their communities.

With microloans, they receive the capital they need to grow their business. And they also receive encouragement knowing that someone else believes in what they are doing!

What is your microloan policy?

20% of profits go back to fund microloans in the country where the tote was from.

So for example, when we sell a Peru tote, 20% of the profits from that sale will go towards a microloan for someone in Peru.

When the microloan recipient pays back the loan, we use the repayment to buy more fabric from that country.

We then make more totes out of the fabric, thus starting the cycle all over again.

How can I help Taaluma Totes fund more microloans?

Help us help others!

First, you can help us by buying our products. Every purchase helps fund a microloan.

Second, you can also tell your family and friends about us. Since our creation, our business has been fueled by happy customers sharing us with the people they know.

We’d be so honored to have your (and your friends’ & families’) support.

Third, you can read up on past microloan stories HERE.

Here’s to leaving the world a better place than where we found it!

-the Taaluma Team